- Presumed-reliance (“fraud on the market”) theories, which SCOTUS is likely to reconsider in Halliburton, aren’t just confined to securities litigation, but crop up in various other areas of litigation including third-party payer drug suits [Beck, Drug and Device Law; more background]

- Why restrict alienability?, pt. CLXXI: Neil Sobol, “Protecting Consumers from Zombie-Debt Collectors” [NMLR/SSRN]

- Will Congress step in to curtail fad for eminent domain municipal seizure of mortgages? [Kevin Funnell, earlier here and here]

- More commentary on J.P. Morgan settlement [Daniel Fisher, Michael Greve, earlier here, here, and here]

- Judge Jed Rakoff: Why have no high level execs been prosecuted over financial crisis? [Columbia Law School Blue Sky Blog]

- Treasury Department’s Financial Stability Oversight Council (FSOC) turns its sights to investment advisers. The logic being…? [Louise Bennetts, Cato/PJ Media]

- Property-casualty insurer association challenges new HUD disparate-impact rules [Cook County Record]

Posts Tagged ‘banks’

Banking and finance roundup

- J.P. Morgan and the Dodd-Frank system: “With Wall Street’s capable assistance, government has managed to institutionalize and monetize the perp walk.” [Michael Greve, related from Greve on the self-financing regulatory state]

- Harvard needs to worry about being seen as endorsing its affiliated Shareholder Rights Project [Richard Painter]

- Under regulatory pressure, J.P. Morgan “looking to pull back from lending to politically incorrect operations like pawn shops, payday lenders, check cashers” [Seeking Alpha]

- Rare securities class action goes to trial against Household lending firm, HSBC; $2.46 billion judgment [Reuters]

- Car dealers only thought they were winning a Dodd-Frank exemption from CFPB. Surprise! [Carter Dougherty/Bloomberg, Funnell]

- “Memo to the Swiss: Capping CEO Pay is not an Intelligent Way of dealing with Income Inequality” [Bainbridge]

- American Bankers Association vs. blogger who compiled online list of banks’ routing numbers [Popehat]

“The agency has filed more lawsuits against lawyers…”

“…than [against] almost any other group.” Can you guess which new federal agency is being referred to? [National Law Journal]

Another Michigan structuring case

Headline, from WWJ: “Sterling Heights Gas Station Owner Says IRS Grabbed $70K From His Bank Account For No Reason” Mark Zaniewski, “owner of Metro Marathon in [suburban Macomb County], said the IRS emptied out his bank account twice over the course of a week this spring.” No charges have been filed; Larry Salzman of the Institute for Justice, representing Zaniewski, says the accounts were seized on suspicion of bank “structuring” (knowingly arranging deposits to fall below $10,000), even though some deposits were over that threshold. Salzman says his client has been waiting seven months for his cash and in the mean time is unable to get a hearing before a judge. IJ recently took on a structuring case involving a grocer in nearby Fraser, Mich. Earlier on structuring and its intersection with forfeiture law here, here, here, etc.

Update via Dan Alban on Twitter: “BREAKING: IRS voluntarily dismisses Michigan forfeiture cases, will return seized money to owners of family grocery store and gas station. Doesn’t get feds out of IJ’s separate constitutional lawsuit re: right to prompt hearing, Dehko v. Holder.”

Original holder donated patent to non-profit for “public good”

So how exactly did it wind up in the hands of a patent troll? [Mike Masnick, TechDirt]

At Treasury’s mercy

How “money laundering” regulations give the U.S. Treasury power to destroy foreign banks [Stewart Baker, Volokh] Meanwhile, if Canadians imagine that the Foreign Account Tax Compliance Act (FATCA) is something only Canadian-Americans need to worry about, they should think again [Maclean’s]. Excerpt:

To say that FATCA is controversial is an understatement. The law is so complex and onerous to implement that some foreign banks have reportedly kicked out their U.S. clients in order to avoid dealing with it. Americans living abroad are queuing to give up their U.S. passports over it. The other problem with FATCA is that it asks foreign banks to do things that are often illegal in their home countries, such as passing on certain private information.

Another note on the J.P. Morgan penalty

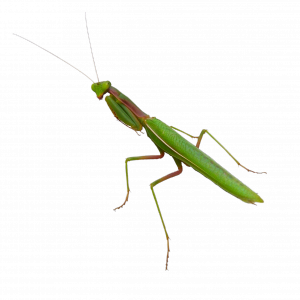

Kevin Funnell, on “The Long-Range Consequences Of Adopting The Mating Habits Of A Praying Mantis,” quotes Matthew L. Brown in Boston Business Journal on the consequences of slamming the institution that agreed to help rescue WaMu and Bear Stearns, and is now paying for their sins: “It’ll be a long time, indeed, before a big bank answers the federal help line.” Related: Daniel Fisher, Forbes.

Kevin Funnell, on “The Long-Range Consequences Of Adopting The Mating Habits Of A Praying Mantis,” quotes Matthew L. Brown in Boston Business Journal on the consequences of slamming the institution that agreed to help rescue WaMu and Bear Stearns, and is now paying for their sins: “It’ll be a long time, indeed, before a big bank answers the federal help line.” Related: Daniel Fisher, Forbes.

Banking and finance roundup

- “Dodd-Frank and The Regulatory Burden on Smaller Banks” [Todd Zywicki]

- Side-stepping Morrison: way found for foreign-cubed claims to get into federal court? [D&O Diary]

- “Alice in Wonderland Has Nothing on Section 518 of the New York General Business Law” [Eugene Volokh, swipe fees]

- “Financial Reform in 12 Minutes” [John Cochrane]

- Why the state-owned Bank of North Dakota isn’t a model for much of anything [Mark Calabria, New York Times “Room for Debate”]

- Regulated lenders have many reasons to watch SCOTUS’s upcoming Mount Holly case on housing disparate impact [Kevin Funnell]

- Cert petition: “Time to undo fraud-on-the-market presumption in securities class actions?” [Alison Frankel]

“Your No. 1 client is the government”

My new Cato post tells how on-site feds increasingly direct big business decisions.

P.S. Related thoughts on deferred prosecution agreements from Brandon Garrett and David Zaring at NYT “DealBook.”

Institute for Justice tackles a structuring-forfeiture case

The Institute for Justice is defending the owners of a grocery store in Fraser, Mich. who saw their bank account seized under forfeiture law on suspicion of structuring deposits (keeping them below $10,000 on purpose to avoid reporting). Video here. We’ve been covering the results of structuring law, and its intersection with forfeiture powers, for a while now, and its nice to see the issue attracting the notice of a group as formidable and high-profile as IJ.